A Negative Interest Rate as A Tax Is Equivalent to Inflation as a Tax

The only math you need to prove MMT and Neofisherism

Here is a link to the google doc spreadsheet if you want to play with it.

MMT vs Neofisherism vs Fiscal Price Theory

There is a tension between the MMT camp, and others who promote either neofisherism, or fiscal price theory. I have clarified previously how MMT focuses on fiscal bidding. In MMT lingo, “the government is the price setter”. More formally, Mosler’s statement on this is:

The price level is a function of prices paid by government when it spends or collateral demanded when it lends.

This quote can be found in Mosler’s book 7 deadly innocent frauds, on page 113

Original Link On Mosler’s Website: 7 deadly innocent frauds

Permanent cache at archive.is: 7 deadly innocent frauds

Here is Mosler’s full explanation on the next page:

Let’s return to the first part of the statement - “the price level is a function of prices paid by govt. when it spends.” What does this mean? It means that since the economy needs the government spending to get the dollars it needs to pay taxes, the government can, as a point of logic decide what it wants to pay for things, and the economy has no choice but to sell to the government at the prices set by government in order to get the dollars it needs to pay taxes, and save however many dollar financial assets it wants to. Let me give you an extreme example of how this works: Suppose the government said it wasn’t going to pay a penny more for anything this year than it paid last year, and was going to leave taxes as they are in any case. And then suppose this year all prices went up by more than that. In that case, with its policy of not paying a penny more for anything, government would decide that spending would go from last year’s $3.5 trillion to 0. That would leave the private sector trillions of dollars short of the funds it needs to pay the taxes. To get the funds needed to pay its taxes, prices would start falling in the economy as people offered their unsold goods and services at lower and lower prices until they got back to last year’s prices and the government then bought them. While that’s a completely impractical way to keep prices going up, in a market economy, the government would only have to do that with one price, and let market forces adjust all other prices to reflect relative values. Historically, this type of arrangement has been applied in what are called “buffer stock” policies, and were mainly done with agricultural products, whereby the government might set a prices for wheat at which it will buy or sell. The gold standard is also an example of a buffer stock policy. Today’s governments unofficially use unemployment as their buffer stock policy. The theory is that the price level in general is a function of the level of unemployment, and the way to control inflation is through the employment rate. The tradeoff becomes higher unemployment vs. higher inflation. To say this policy is problematic is a gross understatement, but no one seems to have any alternative that’s worthy of debate. All the problematic inflation I’ve seen has been caused by rising energy prices, which begins as a relative value story but soon gets passed through to most everything and turns into an inflation story. The “pass through” mechanism, the way I see it, comes from government paying higher prices for what it buys, including indexing government wages to the CPI (Consumer Price Index), which is how we as a nation have chosen to define inflation. And every time the government pays more for the same thing, it is redefining its currency downward.

“Every time the government pays more for the same thing, it is redefining its currency downward”. That is the most succinct and powerful description of what I believe makes MMT and Mosler’s approach in particular unique.

But for me, even that is too specific. I would replace the word government with currency issuer. And then, even one step further, we can replace the phrase currency issuer with asset issuer.

Now let’s rewrite these two key statements:

The price level is a function of the prices paid by the [currency issuer] when it spends or collateral demanded when it lends.

Every time [an issuer of a financial asset] pays more for the same thing, it is redefining [the value of that asset] downward.

So these important and insightful statements by Mosler, can be generalized to apply to any kind of financial asset. Again, I prefer to say that all financial assets are a monopoly of their issuer.

Inflation as a Tax = Negative Interest Rates as a Tax (but without inflation)

We are going to simplify simplify simplify this math for all of us. A negative interest rate is when you lose money in your account every year. Instead of getting paid interest for saving money, you are charged interest for saving money.

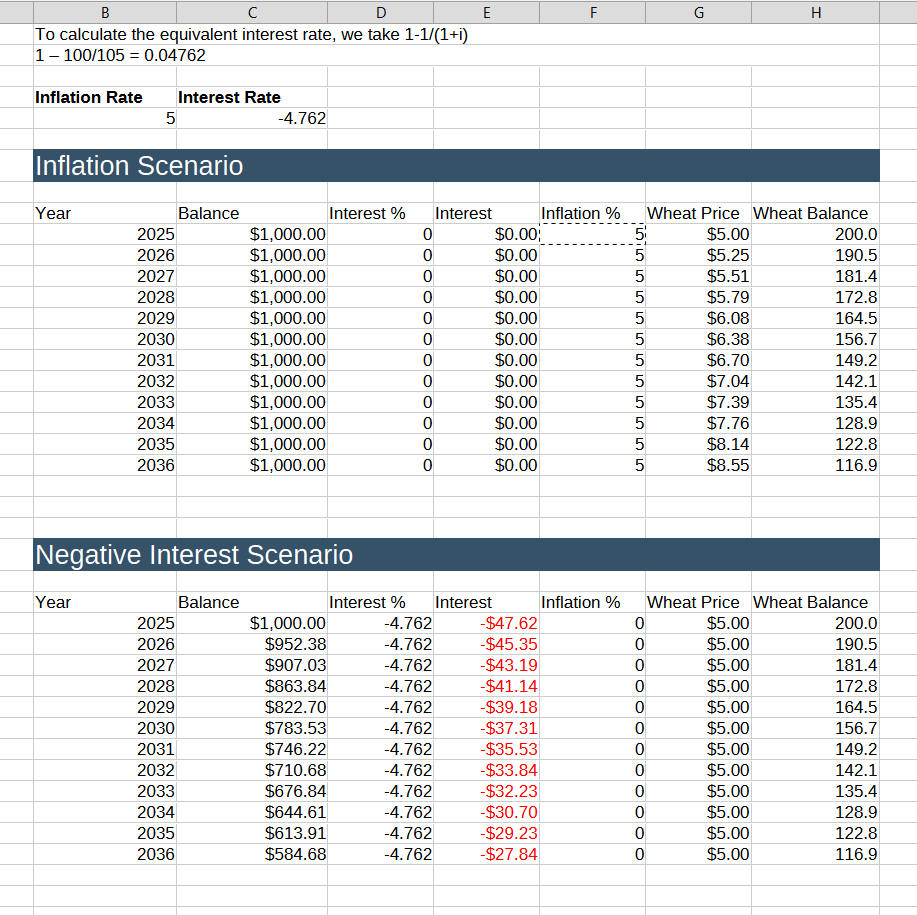

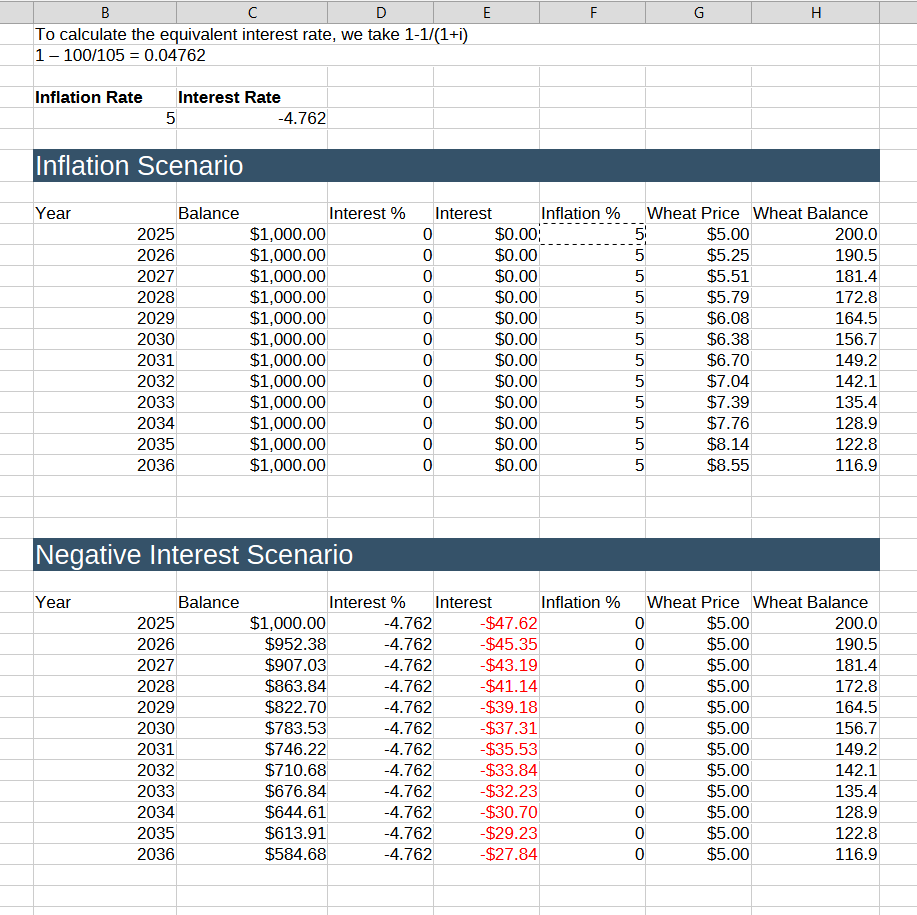

Suppose you have an account with $1000 in it. And further suppose that a bushel of wheat costs $5. So we are going to make a table of two scenarios.

Scenario #1 is inflation.

Scenario #2 is a negative interest rate.

So again, the following table demonstrates that inflation and negative interest rates have equivalent effects on the real purchasing power in account balances:

This is all the math you need to show that neofisherism, and furthermore MMT, 100% works.

This is great pedagogy. I'm copying Jim at MMT101. (So you do not have to join the whatsapp group and compromise your phone security. https://chat.whatsapp.com/KzY3PapULehKbyFdEXQZpi ) I have to be on whatsapp anyway to assist a blind friend overseas. But I'll do a little to help drive readers your way.